Pivoting to Purchase, But Staying Focused on The Digital Future

February 24, 2022

– In 2022, the dramatic shift from refinance to purchase and the overall market contraction requires new strategies as well as renewed focus on cost and efficiency –

With refinance transactions slowing, 2022 will mark a year of significant change for the title and mortgage industries. As Odeta Kushi, deputy chief economist at First American, recently observed:

“The Fed clearly faces a very unique challenge in 2022. How to tame inflation without halting the recovery, and the housing market is entering 2022 with double-digit house price growth, strong underlying demand and near record-low supply. A modest increase in mortgage rates due to tighter monetary policy may actually bring some much-needed house price moderation.”

Accelerating Digital Transformation in 2022

February 17, 2022

– In 2022, forward-looking clients are investing in automation and workflow enhancements to work faster, smarter and more cost effectively –

What will 2022 look like for the title industry? The Mortgage Bankers Association (MBA) expects origination volume to reach $2.6 trillion this year, which would rank as the fourth best year for origination volume in the last 15, but not quite the frenzy experienced in 2021.

DataTrace Launches Single Integration Gateway to Accelerate Implementation of Automated Title Production

February 14, 2022

– One Application Programming Interface (API) connection now empowers title companies to accelerate automated title production implementation while providing access to the full suite of DataTrace data, products and services –

DataTrace announced today the launch of the DataTrace Digital Gateway, a single API connection to over 100 DataTrace products and services that helps title companies accelerate the implementation of their automated title production efforts.

Tax Services are a Natural Starting Point for Title Companies’ Digital Transformation

January 20, 2022

- Tax Services are a Natural Starting Point for Title Companies’ Digital Transformation -

Recently MortgageOrb spoke with Alan Martin, VP, Product Management, DataTrace to discuss the importance of digitizing and automating property tax information. Check out the featured article:

Solving the Property Tax Status Reporting Conundrum

December 7, 2021

There’s an old saying: “If it ain’t broke, don’t fix it.” While that sounds like good advice, it assumes two very important things: first, that the observer is right and the process isn’t broken and second, that a significantly better way does not exist.

On a macro level, there are many manual steps within the traditional title process that have worked well for decades but are now being re-thought and re-engineered - not because they are broken - but simply because the industry is rapidly becoming more digital and traditional workflows slow, rather than accelerate, this process.

Over the past few years, great strides have been made by our industry to bring operational and human efficiency and productivity to the title production workflow while driving down risk and cost.

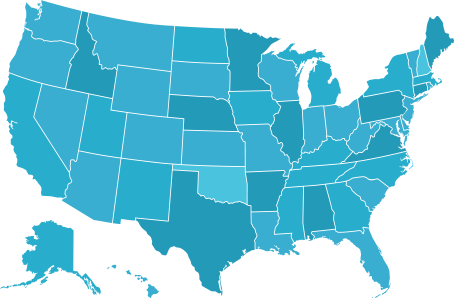

Geographic Coverage

Geographic Coverage