There’s an old saying: “If it ain’t broke, don’t fix it.” While that sounds like good advice, it assumes two very important things: first, that the observer is right and the process isn’t broken and second, that a significantly better way does not exist.

On a macro level, there are many manual steps within the traditional title process that have worked well for decades but are now being re-thought and re-engineered - not because they are broken - but simply because the industry is rapidly becoming more digital and traditional workflows slow, rather than accelerate, this process.

Over the past few years, great strides have been made by our industry to bring operational and human efficiency and productivity to the title production workflow while driving down risk and cost.

Tackling a Decades-old Roadblock: Tax Reporting

Acquiring, normalizing and reporting accurate tax status information remains a vital step in title production. On the surface, this process appears to be straightforward, however, it has resisted full digitization largely due to five contributing factors:

1. Obtaining and managing tax data across numerous sources requires time, resources & analysis.

For decades, the title industry has been obtaining tax information, either by doing it in-house using websites and phone calls, or through a patchwork of regional vendors and offshore resources. Title companies have confirmed tax status to determine if there are any tax encumbrances that could cloud a property’s title and to collect and pay taxes due at closing. Over time, this process has been done in-person at county courthouses, by mail, fax and phone, and, more recently, by email and by searching tax agency websites.

2. Decentralized records and processes of tax data retrieval through disparate sources results in process inefficiencies.

Even with some digitization of acquiring data through in-house or outsourced options, there’s the reality of multiple and decentralized state tax jurisdiction reporting and formats. These challenges lead to manual tax search procedures which may, ultimately, obtain the accurate information but requires manual process workarounds.

3. Non-standardized, manual tax searches in multiple tax formats across diverse sources creates exposure to mistakes in process verification and data interpretation.

Once the data is assembled, the next step is to convert that information into a format that is consumable by commercial title underwriting production systems. Many title companies resort to manually keying information because there’s no link or API to their current system – doubling the workload. This process makes the information susceptible to error likely by misinterpreting the data, which was easy to do given the wide array of taxing agency’s reports and forms.

4. Managing varied and seemingly endless tax county changes and requirements is tedious work.

The idiosyncrasies of more than 3,100 counties and 23,000 taxing authorities across the country requires title companies to maintain and manage literally hundreds of thousands of county-level tax requirements. These requirements can change each time a local bond or voter-approved initiative is passed or implemented. Historically, the methods ultimately produced the right answers, but the manual and time-consuming workflow often further strains limited in-house resources.

5. Manual tax data entry is required

Finally, manual entry of the above-mentioned disparate records into a title company’s production system opens the door to rekeying errors, turnaround time, cost and quality control challenges.

DataTrace TaxSource®: A Fully Digitized Solution

Simply stated, DataTrace TaxSource® solves for each of the five factors mentioned above through a fully automated, real-time solution for sourcing accurate tax status nationwide. All users must do is request a report and DataTrace TaxSource manages the rest.

Unlike a myriad of tax forms and reports used by local taxing agencies, DataTrace TaxSource information is presented in a standard, easy-to-understand format so you don’t have to be a tax expert to understand it. Since the solution validates the data, internal resources can focus on complicated situations, rather than reviewing and validating every report. A network of experienced regional tax specialists is also available to support clients using the platform.

The solution can access tax records nationwide to deliver:

• Current year bill details

• Assessed values with exemptions

• Tax agency requirements

• Prior-year delinquency records with payoff amount

Standardized, Integrated & Consumable

Thanks to data standardization, users get the same data set back and in the same format, whether it's a JSON response through our API, or if it's in the PDF form. This is the case whether the search is completed through automated processes using data files and tax collector websites, or through manual search processes requiring phone calls, faxes, mail requests or onsite searches.

DataTrace TaxSource also provides seamless integration directly into commercial and propriety title production systems through robust API integrations. This digital connection creates time efficiencies and prevents data errors to support even the quickest title closings. Order access is also available through a convenient user interface for individual transactions, as well as batch order and fulfilment for larger orders.

Today, DataTrace TaxSource is available through several DataTrace platforms, including DT-API, DataTrace System (DTS), TitleFlex™ and Advanced Data Solutions. So, this eliminates the need to rekey information, reducing errors and helping to speed decision-making.

DataTrace TaxSource has succeeded in solving the decades-old tax reporting roadblock by doing all the heavy lifting and creating a most elegant solution for the title industry. Tech-forward innovators like DataTrace are continually challenging themselves to identify and digitally solve similar ingrained tasks and processes. The end result: further digital automation, accuracy, efficiency and cost reduction for the title industry. Explore TaxSource digital automation today.

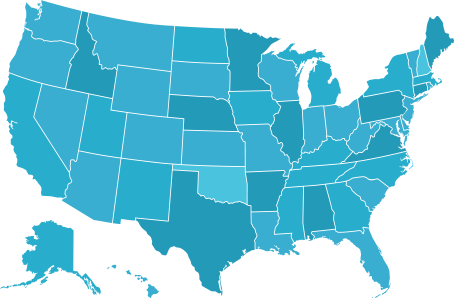

Geographic Coverage

Geographic Coverage