– As the need for speed continues to play a pivotal role in mortgage origination, the need for smart technology and improved automation will separate the winners from the rest –

The mortgage market has always valued speed: the faster a lender can approve a borrower the more likely that loan will close. It’s why, in recent years, lenders have invested billions to improve their customer experience through innovations like digital point-of-sale solutions and faster verification platforms, and why they are continually pushing partners, like title companies and AMCs, to deliver faster results.

In a normal purchase market, lenders and their clients put a premium on speed: the buyers usually have a timetable (get in before the school year begins, for example), and the sellers often need the cash to close on their next home. But 2022 is hardly a normal purchase market. Inventory is at, or near, all-time lows. Bidding wars are commonplace, and borrowers are increasingly losing out to cash-buyers. To compete, many lenders are emphasizing, even heavily advertising, how fast they can approve and close. Some are also developing innovative solutions that enable borrowers to be cash buyers.

To keep up with these clients, title companies will need to re-think manual processes that slow their decision-making and add internal costs. As we’ve discussed earlier this series, digital transformation and automation, especially with low-value and traditionally manual tasks, are essential to succeeding in a hyper-competitive purchase environment.

Going digital with property tax reporting.

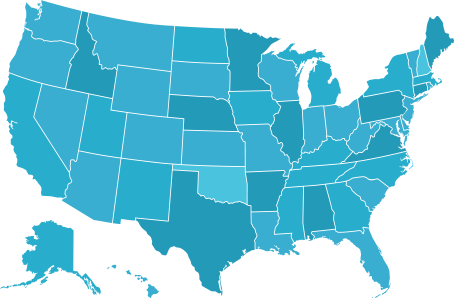

Property tax reporting and manual title searches are two processes that clearly fall into the “must re-examine” category. At many title companies, tax reporting is not only a time-consuming task, but one that is also prone to data errors. Collecting data from the more than 3,000 tax agencies in the U.S. is challenging, costly and inefficient. Not to mention, once the data is collected, it is often in a form that is incompatible for direct integration with leading title production systems, and so must be re-keyed.

That’s why we created DataTrace TaxSource®, a centralized on-demand tax reporting platform with access to tax records nationwide. The tax data is delivered in a standardized format with experienced regional tax specialists on hand to support client requests and questions. This allows staff to shift their focus to more critical, high-value tasks, reducing both production time and cost, all while enhancing the borrower’s experience.

Automating title search and commitment.

Likewise, DataTrace TitleIQ™ Enterprise provides efficient, automated title search production capabilities with customizable business rules that improve title companies’ ability to compete on faster decisioning. Accurate title search packages are delivered in minutes, including property and general name indexes, chain of title and appropriate image tags, with direct integration into leading title production systems. And rules-based automation standardizes workflows and further increases efficiencies and accuracy by managing core title search requirements, title coding and phrase code data mapping, all reducing labor costs and data errors.

As the need for speed continues to play a pivotal role in mortgage origination, the need for smart technology and improved automation will separate the winners from the rest.

To find out how DataTrace can help your business, we invite you to schedule a meeting.

Check out our Efficiency Through Automation Series:

Geographic Coverage

Geographic Coverage