— At the halfway point of 2023, attendees at last month’s NS3 Conference in St. Louis were focused on where the opportunities are now, major tech trends and next year’s outlook.—

Overall, the mood at the conference was cautiously optimistic. Attendees largely feel that the market will gradually improve, though perhaps not dramatically, in 2024. Most agreed that we’ll have to wait and see where inflation and the Federal Reserve are later this year.

As many observers have been predicting, home equity has become the new “north star” for many title and settlement service providers. During the first half of this year, the market for HELOCs and HELs was strong and seemed to be picking up the slack created by the decline in cash-out refinances. In late Spring, there was a dip in home equity volume, but attendees are seeing an uptick in the past 30 days.

Title companies are also finding new methods to help their lender clients close more deals with alternative solutions. This is particularly true for lines and loans below a certain dollar threshold and clients with better credit and higher equity.

One client shared they have had a significant level of success using the Legal and Vesting solution from TitleFlex® by DataTrace® as an alternative to full searches for lower risk transactions. The deliverable meets their lenders’ risk criteria and can provide decisions in 20 to 30 minutes, with little or no manual costs. The same company is also bundling other products, including valuations and credit, to create a low-cost, superfast HELOC decisioning solution.

At the other end of the spectrum, another client shared at least one of its major lender clients is taking a more cautious approach to home equity with its minimum requirement now a two-owner search.

Unlike first mortgages, home equity products tend to be less standardized, so lenders and their title partners have more leeway to evaluate ownership and valuation risk. While some providers promote a single home equity solution, at DataTrace our approach has always been to offer the market several options that can meet their risk parameters.

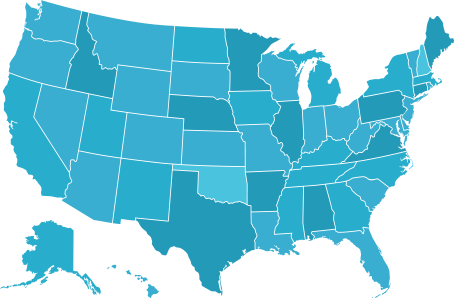

Cost reduction, in all its forms, was another big topic of conversation. Just as AI and ChatGPT has captured the imagination of the public, there were major presentations on how natural language processing tools will reshape the title and closing experience by removing cost and human processes. Read how AI and automation technology is critical to newly announced DataTrace title plants and expanding coverage across the nation.

Proponents touted the speed and ease of changing documents, interacting with clients and warned now is the time to embrace these technologies or be left behind. Other observers cautioned for better guard rails to be established to protect personal information.

On a more practical level, clients that have significantly reduced headcount were interested in learning about new options—like managed services and automated title search technology that will allow them to scale when the next up cycle arrives.

Request a meeting to learn how we can help keep your business strong — tailored to your business goals.

Geographic Coverage

Geographic Coverage