– Depending on the state and municipality, hidden liens can cause costly legal issues and, in extreme cases, foreclosure. Avoid hidden lien risk by completing municipal lien searches along with the title packages for residential and commercial purchases. –

One might think conducting a title search checks the box in terms of catching all liens – including municipal liens – but unfortunately this is not the case. It can, therefore, be costly to the borrower if unrecorded municipal liens crop up later, and, in a worse-case scenario, result in foreclosure. To be certain no hidden liens exist, a municipal lien search should be completed along with the title search for residential or commercial purchases.

Why is a Municipal Lien Search Important?

Unless a municipal lien is specifically recorded with a county clerk’s office – and for a variety of reasons, many are not – it won’t show up in a title search. Likewise, relying on a municipal website to provide complete information is not advised as many such sites do not have accurate or up-to-date information. These unrecorded or “hidden” liens can include unpaid property taxes, waste, garbage, water, sewer, special assessments, code enforcement, permitting violations, real estate property taxes, and other municipal and county debts collected through the jurisdiction wherein the real property lies. Without conducting a municipal lien search, the buyer may be unaware of these financial obligations and may be responsible for paying them after the purchase is complete, causing costly legal issues and, potentially, in extreme cases even loss of the property.

A municipal lien search can reveal an array of potential risks, allowing the buyer to make an informed decision about the purchase and potentially negotiate with the seller to have the debts or liens satisfied before the sale is final.

Distressed properties, in particular, are at heightened risk for hidden municipal lien judgments. If a property hasn’t been lived in or maintained, there’s no telling what bills for city services haven’t been paid. Homebuyers and investors looking to get a deal on a distressed property should make sure to uncover all hidden risk prior to purchase.

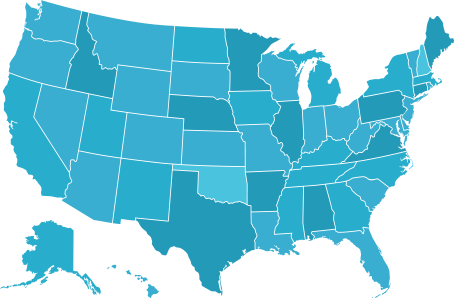

Not All States Are Created Equal

Each state and each municipality is unique in how it records and disseminates municipal lien information. As a result, each municipality must be managed according to its specific payment and delinquent procedures, including whether the municipality can claim a higher lien position, as in the case of super lien states.

For instance, in California, if a homeowner doesn’t pay the water bill, it goes on their credit report and their water is shut off. And if a lien is filed, it becomes public record and is, therefore, available in the title search. But in Florida, which is one of the states with the largest number of municipalities, there are a variety of outcomes for nonpayment, many of which result in hidden liens.

Some states do not require municipal lien identification on the front end. However, others including Florida, Ohio, Michigan, Maryland, Illinois, Indiana, Connecticut, Pennsylvania and New York, have certain requirements in their real estate contracts and purchase agreements that require the seller to provide a clear municipal lien search to the buyer to prove there aren’t any hidden liens.

Likewise, payment and disclosure requirements for lien searches vary across the country. Some municipalities are more sophisticated with online capabilities and others still require postal mail and payments by check.

Although the actions of the past owner created the violations, the debt can often attach to the property, making it a problem for any potential buyer. Buyers everywhere should be aware of how a property’s local government addresses code violations, unpaid utility bills, outstanding special assessments, and other fines or issues.

That’s why, with all these different local requirements, municipality data sources and payment procedures, it’s important to work with a company like DataTrace® that has the most accurate up-to-date data and a national network of state-based experts. Backed by experience, data and technology, DataTrace Municipal Lien Searches ensure all encumbrances are brought to light so there are no surprises for the borrower, the lender or the title company.

To find out how a DataTrace Municipal Lien Search can help buyers make informed decisions about their real estate purchases, avoid lien & foreclosure risk, and ensure a smooth transfer of ownership, schedule a consultation today.

Geographic Coverage

Geographic Coverage